In the intricate landscape of trading, understanding the dynamics of the market can often feel like navigating a labyrinth. The depth of market— a concept that illuminates the layers of supply and demand— plays a pivotal role in shaping trading decisions.

It unveils the undercurrents that drive price movements, offering traders a glimpse into the psychology of their peers. As they scan the order book, they’re not just looking at numbers; they are interpreting the intentions of countless market participants.

With each bid and ask, the market reveals its pulse, pulsating with potential opportunities and hidden risks. This article delves into how the depth of market influences trading strategies, equipping traders with insights to refine their decision-making process in the ever-evolving financial arena.

Together, we will uncover the subtle but significant ways this fundamental aspect of trading can transform the way one approaches the market.

Mechanics of Depth of Market

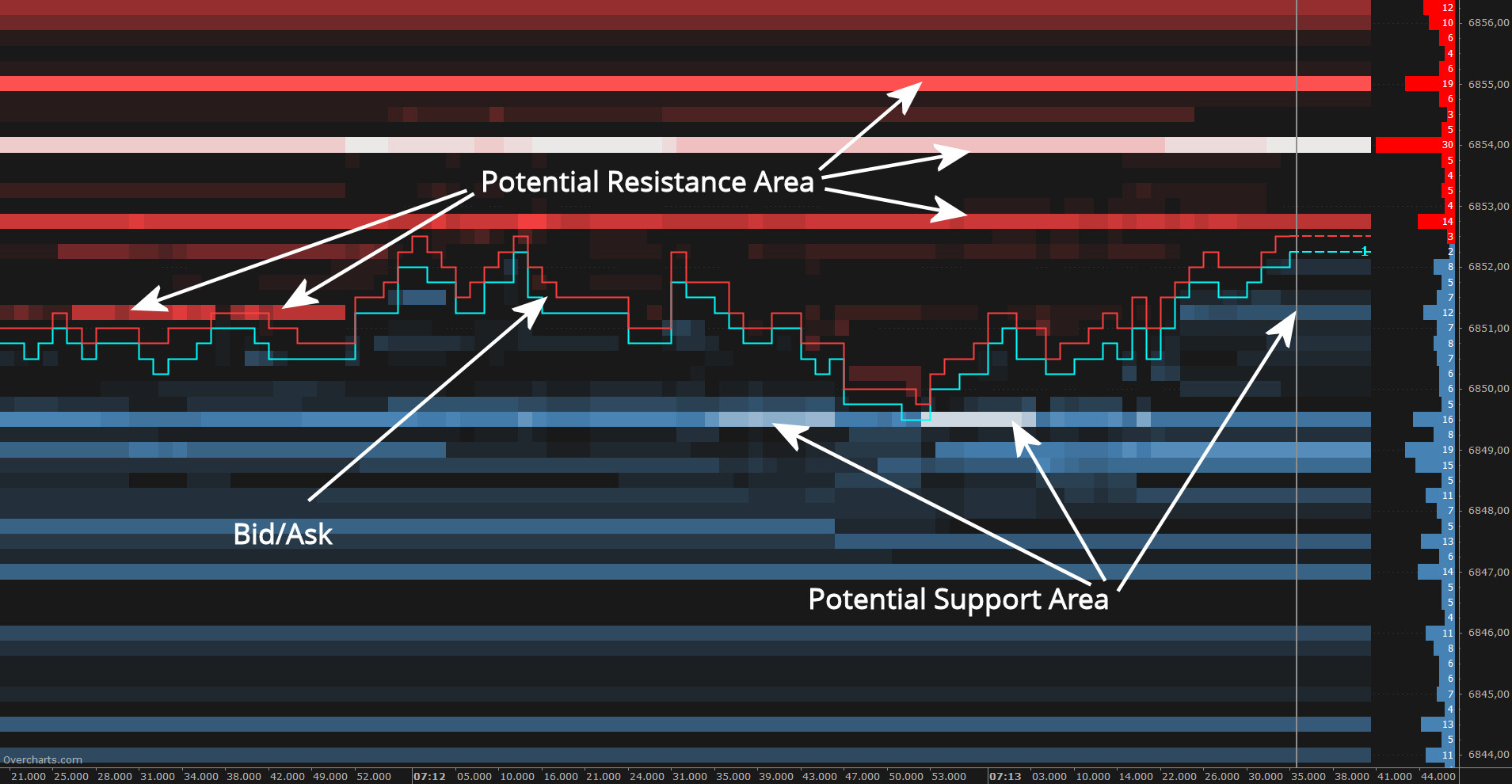

The Depth of Market (DOM) serves as a vital pulse for traders, reflecting a real-time snapshot of market activity. Displayed through a dom chart, it illustrates the liquidity landscape by showing orders waiting to be filled, categorized by price levels. This intricate dance of buy and sell orders not only reveals the supply and demand dynamics at play but also highlights the psychological undercurrents of market participants.

Eager traders can discern potential price movements based on clustered orders, allowing them to gauge where support and resistance may form. Furthermore, sudden fluctuations—think high-volume spikes or gaps—within the DOM chart can signal impending volatility, prompting traders to adjust their strategies on the fly.

Harnessing this information becomes instrumental; it’s not merely about predicting trends but adapting to the ever-shifting tides of market sentiment.

The Role of Depth of Market in Trading Strategies

The Depth of Market (DOM) serves as a critical compass for traders navigating the often-turbulent waters of financial markets. By revealing the layers of buy and sell orders at various price levels, DOM provides invaluable insights into market sentiment and potential price movements. Traders can harness this information to refine their strategies, deciding when to enter or exit a position with greater confidence.

For instance, a trader observing heavy buy orders at a certain price level might interpret this as a support zone, prompting them to consider a strategic entry. Conversely, a sudden shift in selling interest could signal a bearish trend, urging them to reassess their plans.

Ultimately, the DOM doesn’t merely present data; it tells a story—one that savvy traders must learn to interpret to cultivate a successful trading approach. This dynamic interplay between supply and demand, combined with a trader’s analysis, creates an intricate dance that can lead to both triumphs and pitfalls in the fast-paced trading arena.

Conclusion

In conclusion, understanding the depth of market is crucial for traders looking to refine their trading strategies and make informed decisions. By analyzing the supply and demand dynamics reflected in the order book, traders can gain valuable insights into market sentiment and potential price movements.

Tools like the DOM chart can greatly enhance this analysis, providing a visual representation of market depth that aids in decision-making. Ultimately, a thorough grasp of these concepts not only empowers traders to anticipate market behavior but also equips them to navigate the complexities of trading with greater confidence and precision.

As market conditions continue to evolve, leveraging the depth of market will remain a fundamental aspect of successful trading.